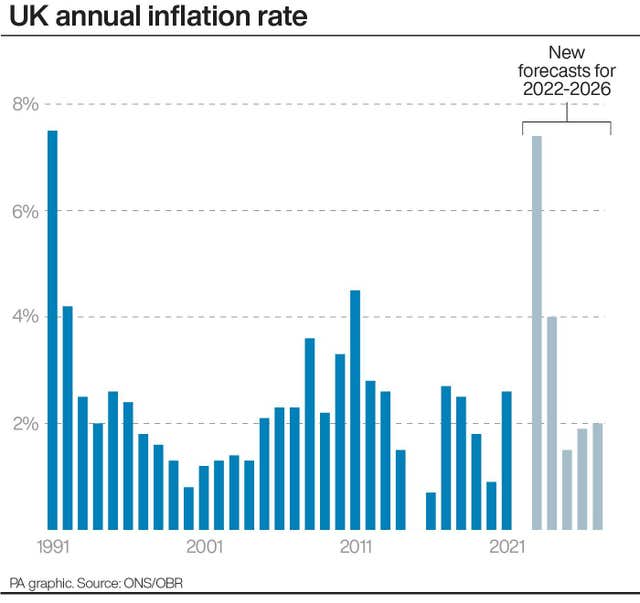

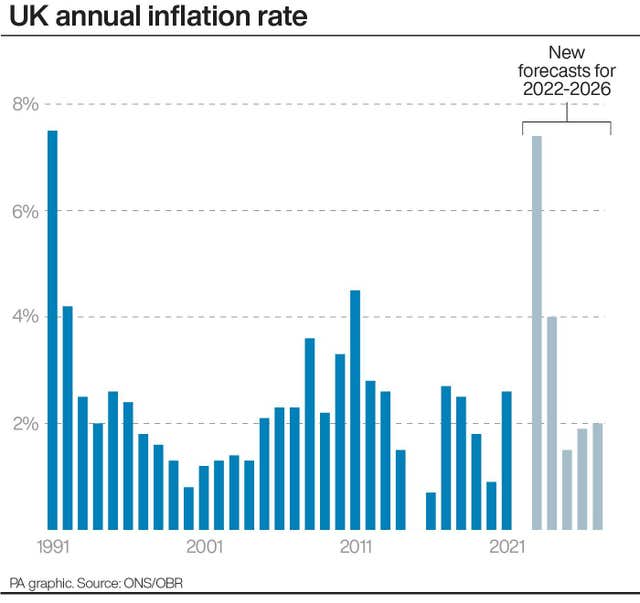

The Office for Budget Responsibility predicted UK inflation will average 7.4% this year, but could jump to 8.7% in October.

23 March 2022

Britain will be hit by a double whammy of sky-high inflation and slower growth as the Ukraine conflict compounds the cost-of-living crisis, the UK fiscal watchdog has warned.

The Office for Budget Responsibility (OBR) slashed its economic growth outlook as it predicted inflation will now average 7.4% this year and could reach 8.7% in the fourth quarter – the highest level for 40 years.

In his spring statement, Chancellor Rishi Sunak said the Ukraine war’s “most significant impact domestically is on the cost of living”, and revealed steep growth downgrades for this year and next.

But he cautioned the economy and public finances could worsen “potentially significantly” as the full impact of Russia’s invasion of Ukraine and the sanctions against President Putin’s regime unfold.

The OBR is now forecasting gross domestic product (GDP) to rise by 3.8% in 2022, down from its 6% previous forecast.

It also downgraded its prediction to 1.8% in 2023 from 2.1% previously while it said GDP would expand by 2.1% in 2024, 1.8% in 2025 and 1.7% in 2026.

The independent economic forecaster said growth will be curtailed as households rein in spending in the face of the worst hit to their finances on record as the Ukraine crisis further disrupts supply chains and sends energy bills soaring.

It said real household disposable incomes will fall by 2.2% per person in 2022-23 – the largest fall since official ONS records began in 1956-57 – and will not recover until 2024, when inflation is finally set to return to the 2% target.

And in a gloomy warning over the Ukraine conflict, it said: “The uncertain course of the invasion of Ukraine and international sanctions brings with it the prospect that energy prices could rise further than markets (and therefore our forecasts) currently assume… driving inflation close to double digits and GDP 0.8% lower in the near term.”

Mr Sunak admitted the OBR forecasts do not take into account the full impacts of the war in Ukraine.

He said: “We should be prepared for the economy and public finances to worsen – potentially significantly.

“And the cost of borrowing is continuing to rise.”

The OBR is forecasting interest payments on UK debt to rocket to £83 billion in 2022-23 due to soaring inflation and rising interest rates – the highest on record and almost four times the amount spent in the year before.

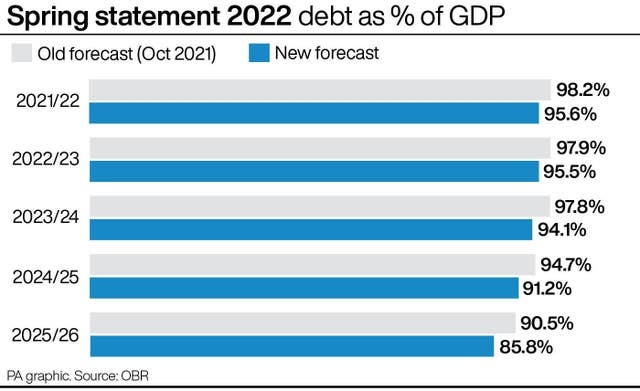

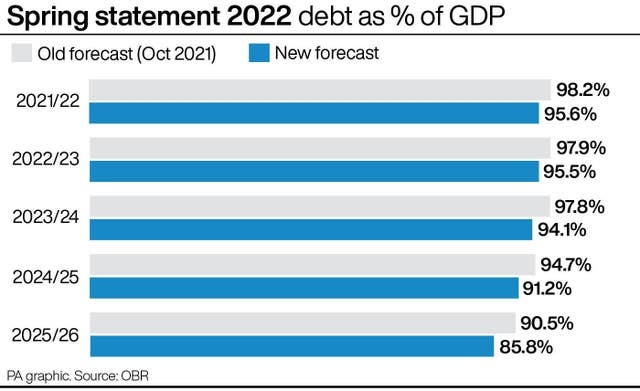

Mr Sunak insisted the Treasury will continue to meet all its fiscal rules, with the OBR expecting underlying debt to fall steadily from 83.5% of GDP in 2022-23 to 79.8% in 2026-27.

But the OBR has revised up its forecast for public borrowing to £99.1 billion in 2022-23, up from £83 billion in the October Budget, as rises in debt interest payments will offset higher tax receipts.

It cut its forecast for borrowing in future years, to £50.2 billion in 2023-24, £36.5 billion in 2024-25, £34.8 billion in 2025-26 and £31.6 billion in 2026-27.

Mr Sunak added: “By 2024, the OBR currently expect inflation to be back under control, debt falling sustainably, and the economy growing.

“Our fiscal rules are met with a clear safety margin.”

But the OBR said: “Few of these fiscal targets were actually met in the past and there are numerous risks to the outlook at present.

“Higher energy prices and inflation as a result of a longer war in Ukraine or tougher international sanctions would reduce the Chancellor’s headroom by over £4 billion.”